Building An Investment Portfolio in Japan

How to Choose Your Investments

The path to successful investing in Japan is straightforward: build a diversified portfolio, minimize costs, and maintain a long-term investment strategy. Low-cost funds like the eMaxis Slim series and similar offerings from other Japanese fund companies exemplify these principles perfectly. With a single balanced fund or a simple combination of domestic and international index funds, you can create a well-diversified portfolio while keeping investment costs far below those of actively managed funds. These low-maintenance, all-in-one funds are an excellent choice for most individual investors in the Japanese market who want to manage their own investments without paying high fees or spending time on complex portfolio management.

All of the portfolios below include Japanese stocks, US stocks, and international stocks (from both developed and emerging countries), giving you exposure to the global equity market.

Risk and Reward

Our recommendations below are for informational purposes only, and don't constitute professional investment advice. All investments carry risk, don't invest what you cannot afford to lose!

What Are The Best Investment Options (2025)?

Below is a list of the most commonly recommended investment options in Japan. Inside of your NISA, iDeCo, or general investment account, you should be able to invest in a majority of these.

| Fund | Target | Expense Ratio |

|---|---|---|

| eMAXIS Slim 米国株式(S&P500) | S&P500 | 0.09372% |

| eMAXIS Slim 全世界株式(オール・カントリー) | World | 0.05775% |

| 楽天・全米株式インデックス・ファンド | US | 0.162% |

| 楽天・S&P500インデックス・ファンド | S&P500 | 0.077% |

| たわらノーロード 先進国株式 | Developed Countries | 0.09889% |

| eMAXIS Slim 先進国株式インデックス | Developed Countries | 0.09889% |

| eMAXIS Slim 全世界株式(除く日本) | World excluding Japan | 0.05775% |

| 楽天・オールカントリー株式インデックス・ファンド | World | 0.0561% |

Our Recommendation

The most straightforward and easy option is choosing the eMAXIS Slim 全世界株式(オール・カントリー) (eMAXIS Slim All Country) portfolio. You will get a broad exposure to the global markets all in one fund, all at an extremely low cost.

How Do I Purchase Investments in Japan?

We've outlined the steps below on how to purchase the above investments using Rakuten Securities. If you're using another brokerage the steps may vary.

Investment Account / NISA Growth Purchases

The process to invest in either your general (一般口座), specified (特定口座), or NISA growth (成長投資枠) investment account is the same.

Step 1: Browse to Mutual Funds

Once you've logged in to your Rakuten Securities account, browse to the mutual funds (投資信託) section, where all of the above funds live.

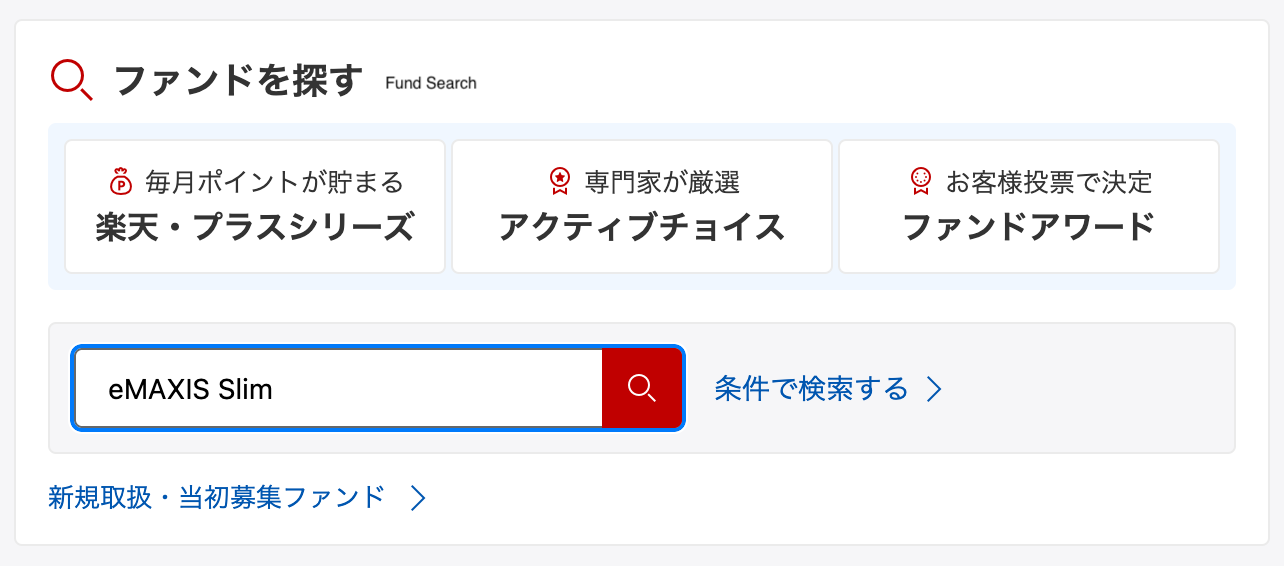

Step 2: Search For Your Preferred Mutual Fund

Find the section to search for a mutual fund by name, and then select the one you are interested in. For example, we're going to search for the eMAXIS Slim series of funds.

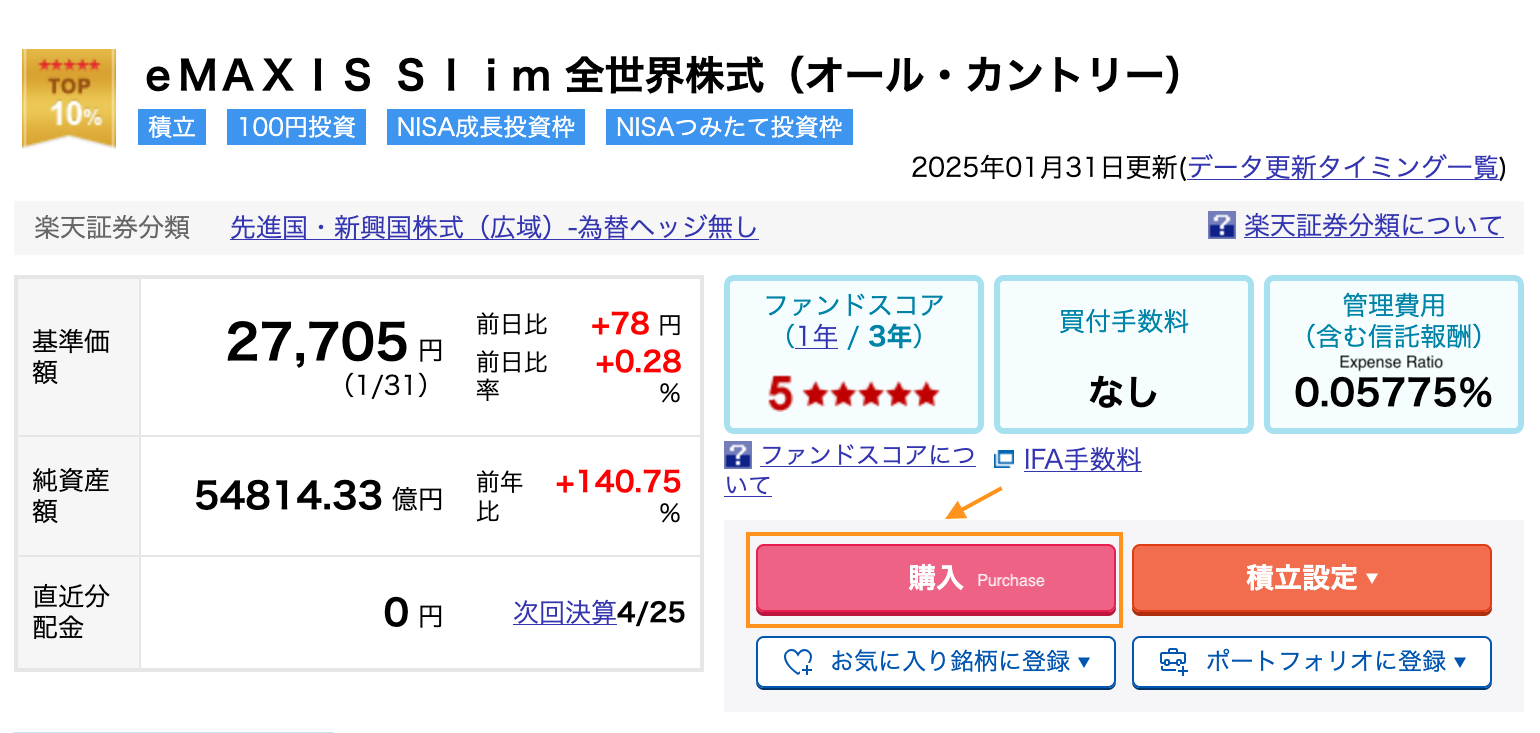

Step 3: View Mutual Fund Information

Once you've found the fund you are looking for, you can browse the page to learn more about it, such as it's expense ratio (the fee you pay to own it), it's past performance, and other disclosures related to the fund. Once you're ready, you can click "Purchase" (購入).

Step 4: Purchase Your Mutual Fund

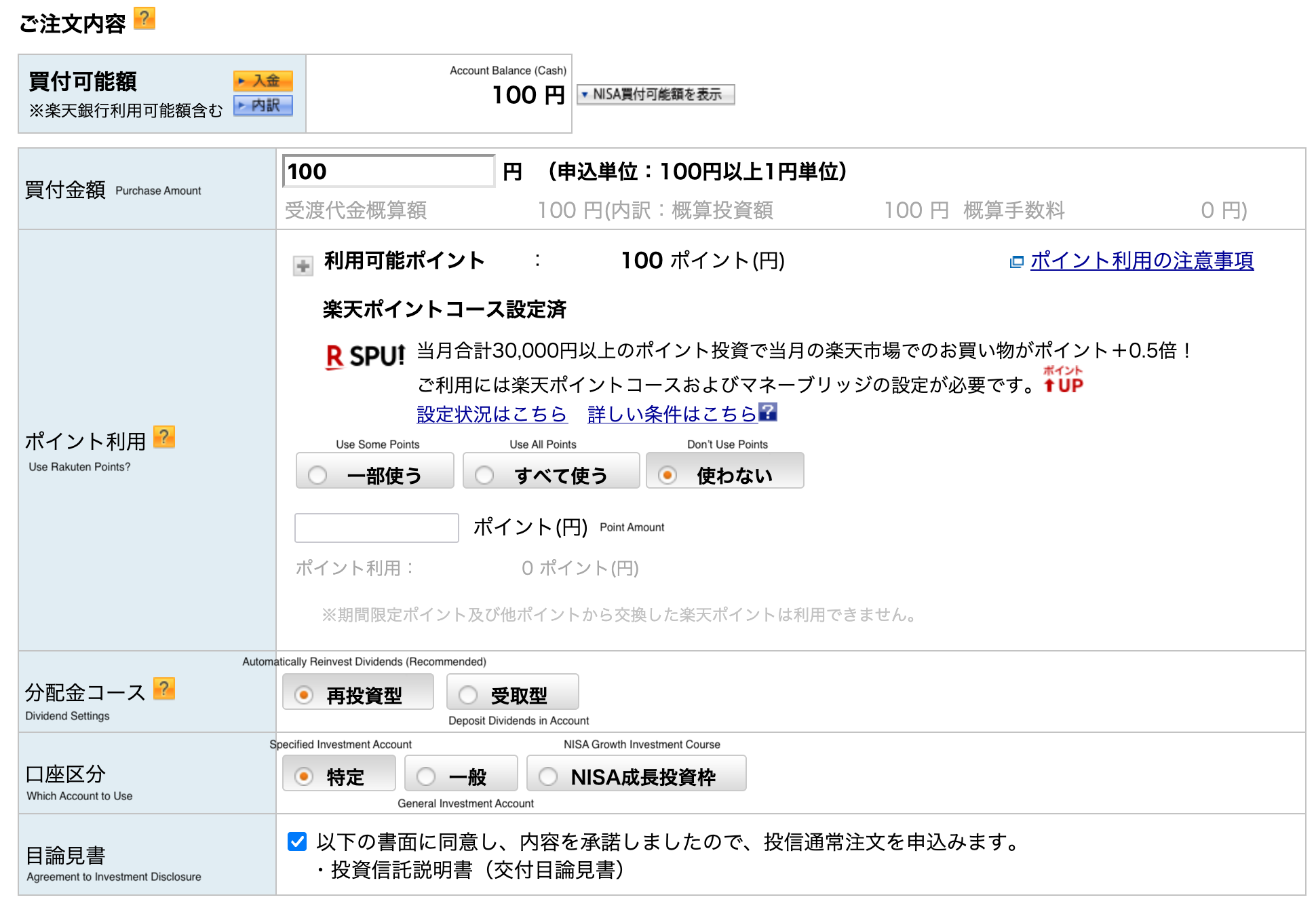

On the purchase page you will have a myriad of options to choose from. We've outlined the most common options for you:

- Purchase Amount (買付金額): You can generally invest a minimum of 100 yen.

- Use Points (ポイント利用): Brokerages often allow you to invest with your accumulated points instead of using cash. This will vary depending on the brokerage.

- Dividend Settings (配当金コース): If your fund issues dividends, you can choose to automatically reinvest them (再投資型) or receive them as cash in your account (受取型). We recommend automatically reinvesting as this will increase the amount of your investment without you needing to do any work.

- Investment Account (口座区分): You can choose to invest in your general (一般), specified (特定), or NISA growth (NISA成長投資枠) account here.

Once you've finished choosing your options, click "Confirm" (確認) and verify your purchase!

NISA Regular Investment Course Purchases

If you remember from our previous chapters, you can invest up to ¥100,000 per month in the NISA Regular Investment Course (つみたて投資枠). Since this is a regular, monthly purchase, the way to set this up is slightly different.

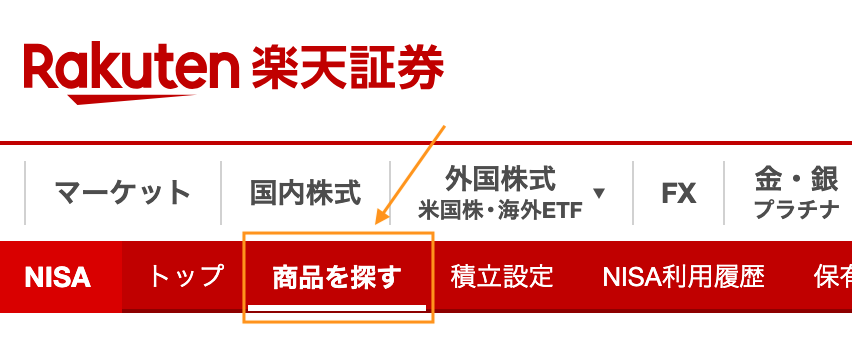

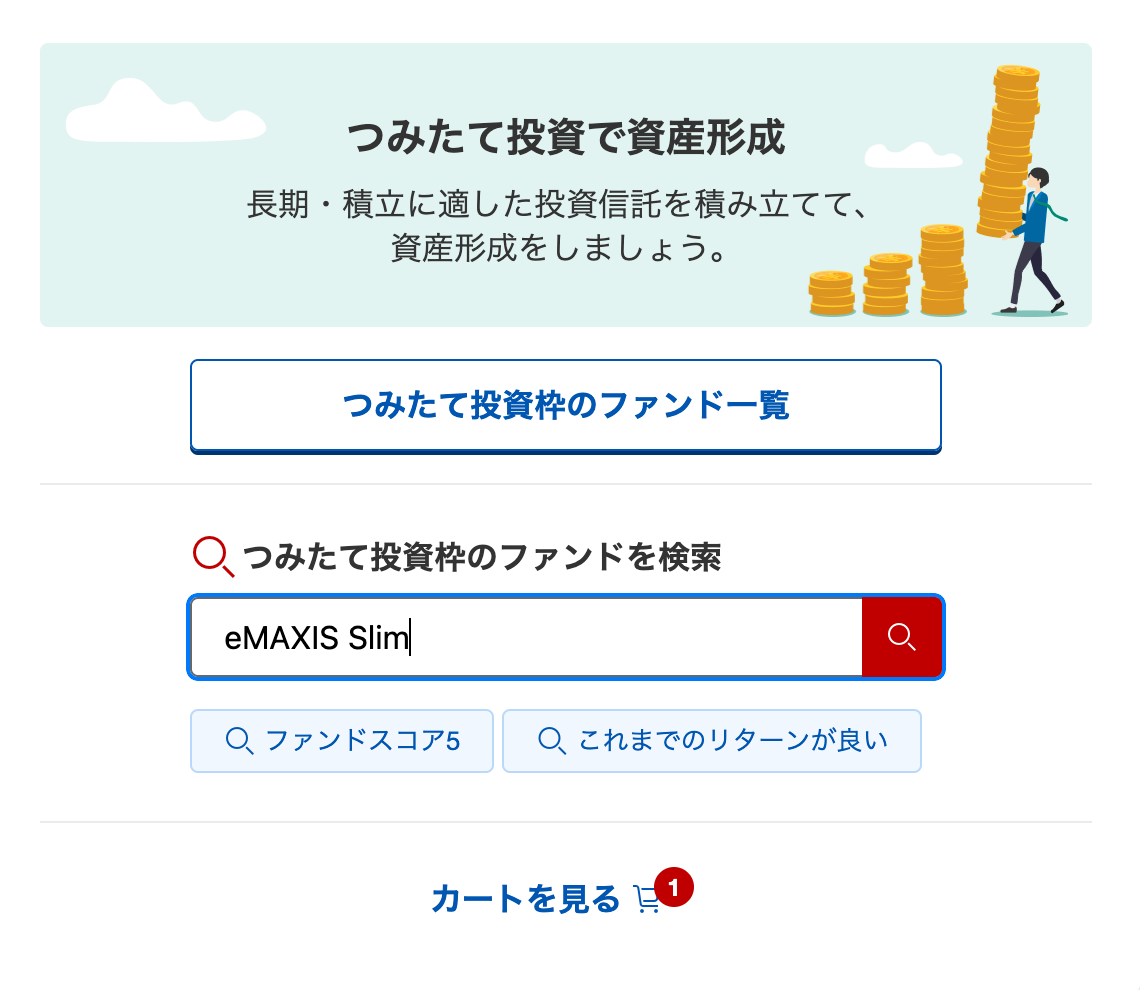

Step 1: Browse to NISA Investment Search

Once you've logged in to your Rakuten Securities account, browse to the NISA section, then to the "fund search" (商品を探す). From there you can search for your preferred fund.

Step 2: Add Your Preferred Fund(s) to Cart

Once you've chosen the fund(s) you want, you can add them to your cart.

Step 4: Set Up Recurring Purchases

On the following pages you can choose how much you wish to invest monthly, how you want to invest (via bank account, credit card, other options). Click through the disclosures and confirm your purchases!

- Monthly Purchase Amount (毎月の積立金額): In total you can invest up to ¥100,000 per month across all funds.

- Dividend Settings (配当金コース): If your fund issues dividends, you can choose to automatically reinvest them (再投資型) or receive them as cash in your account (受取型). We recommend automatically reinvesting as this will increase the amount of your investment without you needing to do any work.