Setting Up Investment Accounts in Japan

Choosing Your Investment Company

Selecting the right investment company (証券会社, shōken-gaisha) in Japan is important to give you the widest breadth of options. Two companies stand out in particular for their combination of low fees, user-friendly interfaces, and comprehensive offerings.

-

Rakuten Securities (楽天証券)

Rakuten Securities appeals to many investors due to its integration with the broader Rakuten ecosystem. If you're already using Rakuten services, you can earn and use Rakuten points through your investments. They also offer competitive fees and a relatively user-friendly interface.

Open an Account With Rakuten Securities → -

SBI Securities (SBI証券)

SBI Securities has earned a reputation as one of Japan's most cost-effective brokers. They offer some of the lowest trading fees in the industry and provide access to a wide range of investment products.

Open an Account With SBI Securities →

This guide will focus primarily on setting up an account with Rakuten Securities, though the process and terminology is largely the same between the two platforms.

Japanese Required

An important note is that almost all investment companies do not support an English user interface. Using a translation tool is recommended if you cannot read Japanese. We will guide you through the process of setting up your account and getting familiar with the terminology.

Preparing Your Documents

Opening an investment account in Japan requires several documents and steps, but the process is fairly straightforward and can be done almost entirely online. Here's what you'll typically need to prepare ahead of time:

- Valid Residence Card (在留カード)

- My Number Card or Notification

- Japanese bank account

- Japanese phone number

Key Point

You must be a Japanese resident with a valid address, phone number, and bank account in Japan in order to sign up for a brokerage account.

Opening Your Account(s)

The following guide will walk you through how to open up an account with Rakuten Securities. You'll be able to open a general investment account (required), iDeCo, NISA, all at the same time.

Step 1: Start the Account Opening Process

Navigate to the Rakuten Securities home page, and click on the 口座開設 (account opening) button. You will be given the option to either sign in with your existing Rakuten account, or create a new one.

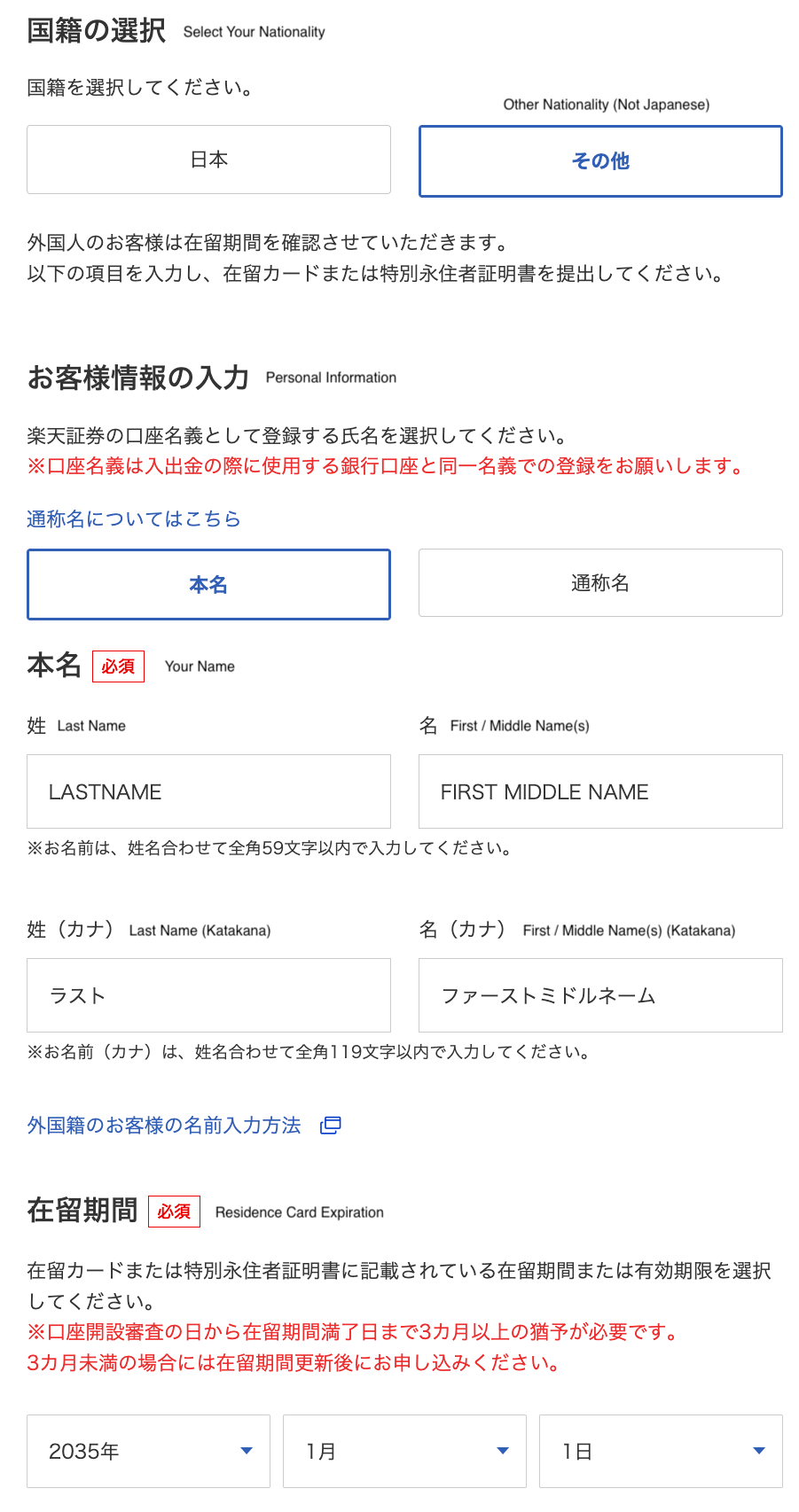

Step 2: Confirm Your Personal Information

Next, you will be asked to input your personal information, such as your name, name in katakana, and residence card information. You will need to have a basic understanding of how to input your name in Japanese in order to proceed with this step.

Step 3: Upload Your Residence Card

You will also be asked to upload a copy of your identification (residence card) for verification. You will need to provide a clear picture of the front and back of the card.

Step 4: Enter More Information and Address

On the next page it will ask for a bit more personal information such as your gender, birthday, as well as your address. Ensure that the address on your residence card matches the address you provide in these fields. You will also need to enter in the same information in katakana.

Step 5: Opening a General Investment Account

You are required to set up a general investment account when you sign up for most brokerages. These accounts are fully taxable, so you will need to pay on any profit inside of these accounts. You don't have to use this account if you don't want, however.

When opening a general investment account, there are three different taxation methods you can elect to choose from. It can be a bit confusing, so we've outlined each method below:

-

Option 1: No Tax Return Required (特定口座開認する源泉徴収あり)

This is the recommended option for most people. This opens what is called a "specified investment account" (特定口座). This method uses a special account where Rakuten Securities automatically handles the tax filing for you when you receive dividends or investment gains. This means you do not have to file a tax return to claim gains in this account. 20.315% is automatically deducted whenever you make a profit.

-

Option 2: Simple Tax Return by Yourself (特定口座開認する源泉徴収なし)

This opens what is called a "specified investment account" (特定口座). This method doesn't automatically withhold tax, so you will need to do a tax return at the end of the year. Rakuten Securities will provide you with a statement at the end of the year which you can use to file your taxes.

-

Option 3: Regular Tax Return by Yourself (特定口座開設しない源泉徴収なし)

This opens what is called a "general investment account" (一般口座). This method both doesn't withhold tax, nor does it provide you with a statement. You will need to manually track your gains and losses and accurately file them yourself on your tax return.

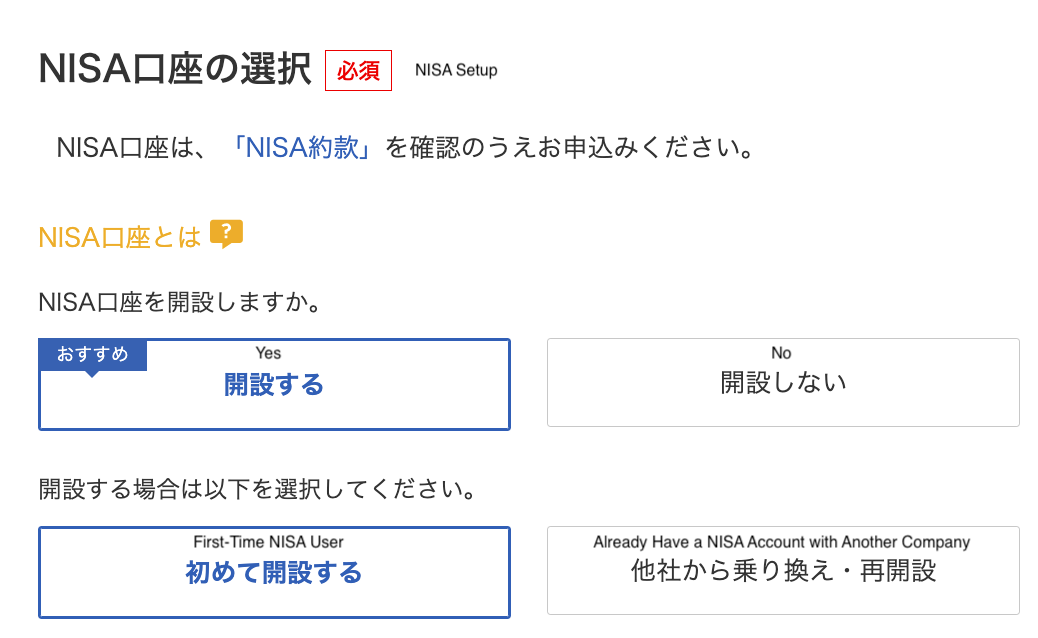

Step 6: Setting up a NISA Account

You can elect to open a NISA account at the same time as you open the general account. As outlined in our previous chapter, this account is tax-free and is a great way to save your money for the long-term.

Step 7: Setting up an iDeCo Account

Towards the end of the process you will also be invited to create an iDeCo account. If you opt to create one of these accounts, you will have to receive some paperwork in the mail to fill out in order to get started, as the process for this isn't entirely online yet. Once it is set up, though, your account will be linked with Rakuten Securities and can be modified online.

Step 8: Receiving the Confirmation Mail

Once you've gone through all of the above steps, you will receive your username and password to get started by physical mail. It can take up to 1-2 weeks for your account to be fully set up.